Top Tech Companies (755)

Since 1998, Bevel has helped thousands of merchants reduce the cost of accepting credit cards. Typically, our program saves merchants 10% - 60% of their existing fees. Bevel was founded on the philosophy of offering our merchants the most aggressive rates in the industry with a level of personalized service that is second to none. Bevel is an innov

Paxful is a peer-to-peer fintech platform built to provide equal access to anyone, anywhere. Paxful enables financial inclusion by giving access to nearly 400 different payment methods to buy, sell, and trade Bitcoin and other digital currencies.

Payfully advances Airbnb hosts the money for their upcoming reservations.

We are a passionate KYB service provider, delivering reliable and accurate information to businesses worldwide. Our team of experts ensure you get comprehensive Know Your Business (KYB) services that perfectly integrate into your in-house business verification systems, ultimately helping you make informed decisions.

TradeBlock is a global source of data and digital currency analysis, which covers all industry topics, including trading and regulation.

CoinOut supercharges cash transactions by allowing customers who pay with cash to save their change to their phone.

InvestCloud, a global leader in wealth technology, aspires to enable a smarter financial future. Driving the digital transformation of the wealth management industry, the company serves a broad array of clients globally, including Wealth and Asset Managers, Wirehouses, Banks, RIAs, and Insurers. In terms of scale, the company’s clients represent more than 40 percent of the $132 trillion of total assets globally. As a leader in delivering personalization and scale across advisory programs, including unified managed accounts (UMA) and separately managed accounts (SMA), the company is committed to the success of its clients. By equipping and enabling advisors and their clients with connected technology, enhanced intelligence, and inspired experiences, InvestCloud delivers leading digital wealth management and financial planning solutions, complemented by a dynamic data warehouse, which scale across the complete wealth continuum. In 2024, InvestCloud was named a CNBC World’s Top Fintech Company, a proof point of the company’s commitment to innovation and client success. Headquartered in the United States, InvestCloud serves clients around the world.

Credit Suisse is a leading global wealth manager with strong investment banking capabilities. Headquartered in Zurich, Switzerland, our operation has a global reach and extends to about 50 countries worldwide across mature and emerging markets with more than 45,000 employees from over 150 different nations.

If you’re driven by new ideas, there’s a lot to look forward to as part of the Technology team at Deutsche Bank. We use technology to give us a competitive edge, developing algorithms that predict price changes over microseconds and producing complex quantitative tools. Together, we're building the digital bank of the future.

Esquire Financial Holdings, through its subsidiary Esquire Bank, is a full-service, federally chartered savings bank serving professional service firms, law professionals, small to mid-sized businesses, and individuals. The bank focuses on servicing these businesses, their owners, and employees, giving them direct access to key decision-makers including our senior and executive managers.

Axoni, a market infrastructure technology company serving the world’s largest financial institutions. Axoni’s platform enables rapid, reliable deployment of critical financial networks and automated, real-time data replication across market participants. Founded in 2017, the company serves banks, asset managers, hedge funds and infrastructure providers across the globe from offices in New York and London.

Mighty is using technology to solve one of the most important and overlooked challenges of our time: the steep obstacles faced by accident victims and the people supporting them to achieve medical recovery, financial security, and legal justice. We reject society’s stigma around personal injury and see it for what it is - a service that, when done right, brings about justice for millions of ordinary people who could not otherwise afford it. While these people are known as plaintiffs, they are also patients and victims navigating a complex system that few understand. Fresh off our 2021 Series B from a top-tier VC, we’re building innovative solutions at the intersection of legal, financial, and health tech for plaintiffs and everyone who supports them.

Fig partners with Family Houston to offer you a loan that is 60% cheaper and designed to get you out of debt. Fig helps you through financial emergencies and build credit towards a better future.

Smartrr helps D-to-C brands by creating a seamless checkout and customer portal experience for their subscribers. Smartrr also empowers teams to be agile and proactive through our real-time analytics and customer success tools.

Cyndx is the most powerful AI-enabled search and discovery platform with one of the most extensive private market data sets – whether you’re a venture capitalist or private equity firm looking to invest in a private company, a start-up looking to raise capital, or an M&A specialist advising on a merger or acquisition. Cyndx’s proprietary AI and comprehensive database of private company information enables it to uniquely surface insights and growth opportunities that would otherwise have gone undetected. It does this through its proprietary AI algorithms, that bring in new data points every day and create meaningful search associations that enable our clients to cast their net much wider – often identifying unique opportunities they may not have otherwise known to look for.

Novus serves capital allocators and managers, helping them enrich and manage their data, extract actionable investment insights, and improve stakeholder communication via visualization and automation. We strive to be the center of the institutional investment ecosystem, where the world’s investors gather to manage their portfolios and engage with one another. Over $120 trillion is invested annually on behalf of pensions, endowments, sovereign funds, private investors, and family offices. Unfortunately, many of these institutions are using outdated and disconnected tools to manage their portfolios. Novus offers comprehensive solutions for multi-asset class portfolios. By providing a single platform that streamlines data processes, quantifies investment skill, uncovers bias, and helps investors plan more accurately, we are helping investors amplify their impact.

Galaxy Digital (TSX: GLXY) is a technology-driven financial services and investment management firm that provides institutions and direct clients with a full suite of financial solutions spanning the digital assets ecosystem. Galaxy Digital operates five synergistic business lines: Trading, Asset Management, Principal Investments, Investment Banking, and Mining. Galaxy Digital's CEO and Founder is Mike Novogratz. The Company is headquartered in New York City, with offices in Chicago, San Francisco, London, Amsterdam, Tokyo, Hong Kong, the Cayman Islands (registered office), and New Jersey.

The Credit Junction helps small and mid-sized businesses take the next step with individualized lending options.

Solidus offers a machine learning-powered surveillance, monitoring and case management suite tailored for digital assets. Our compliance hub helps financial firms detect, investigate and report compliance concerns in digital asset trading efficiently, lowering costs, minimizing false positives and reducing regulatory risks.

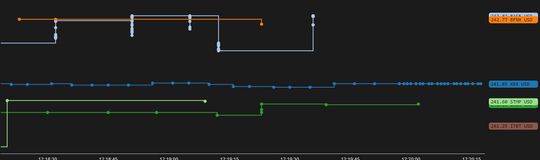

South Street Securities Holdings, through its wholly owned subsidiaries, is a leading provider of U.S. Treasury and Agency repo financing to banks, broker dealers, and other capital market participants. The company is a broker-dealer and FICC member running a matched book portfolio that provides low cost financing for high-grade security positions and a source of secure short-term investment for its customers' excess funds. South Street Securities also provides other servicing, collateral management, technology, and administrative services for banks, broker dealers and other capital market participants.

.png)

.jpg)