Top Tech Companies (742)

Don't see your company?

Create a company profileSumUp believes that every business should have access to affordable, easy-to-use financial solutions, no matter their size. That’s why more than 3 million businesses worldwide rely on SumUp to run their business. What started out as one card reader has now turned into a range of payment hardware, banking solutions, marketing, and loyalty tools, invoicing, and so much more. From sales and marketing to product and engineering, our cross-functional US team works together to ensure that small business owners can be successful doing what they love.

EY is a global leader in assurance, tax, transaction and advisory services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders.

We create next generation alpha for trading financial instruments.

eDeriv Technologies envisions a shift to a fully electronic marketplace for OTC equity derivatives allowing traders to source liquidity electronically, introducing more efficient price-discovery and streamlined trade processing workflows. The eDEX Crossing platform provides for dealer-to-dealer electronic quoting, RFQ, execution, and post-trade processing tailored to the needs of Delta One trading desks. This unique, end-to-end solution delivers reduced trading costs, improved risk management and greater operational efficiencies. Specialties: Equity Derivatives, OTC Derivatives, Delta One, Inter-Dealer Technology, Equity Swaps

Tomo is a fintech mortgage lender who's goal is to create a better home buying experience. We know that together we can deliver an experience that is easier, more efficient, and more predictable. Our digital mortgage platform and purchase-focussed mortgage process provides buyers with the confidence that they need in their rate, support, and in their outcomes.

Ellevest helps women+ take control of their financial futures through a digital money membership that includes access to financial planning, career coaching, investing, and banking, as well as a private wealth management service.

Debitize is a new personal finance tool that makes it easy to use credit cards responsibly by giving you the discipline of a debit card.

Patch Homes is a modern finance company that helps homeowners tap into their home equity without selling or adding additional debt (and the burden of monthly payments).

Rockpapr is a young NYC based startup building the next generation of spend and expense management tools for businesses. Simply by providing a backing payment source, our customers can generate virtual and physical credit cards with dynamic spend controls and integrations into their ERP and Expense systems.

We're a high-growth Fintech SAAS start-up that uses cutting edge AI, natural language processing and machine learning to revolutionize the way companies protect themselves from criminals, terrorists and money launderers.

With offices in New York City, Atlanta, San Diego, & Hyderabad-India, FinMkt operates the leading multi-lender marketplace for consumer and small business loans. From customer acquisition to product matching to tracking and reporting, our highly secure, patent-pending technology solutions are the gold standard of the financial marketplace ecosytem.

At the forefront of mobile innovation in New York City's vibrant tech landscape, we are a rapidly expanding mobile app development powerhouse transforming ideas into cutting-edge digital experiences. As one of NYC's fastest-growing tech companies, we combine creative excellence with technical mastery to deliver sophisticated applications that shape how businesses connect with their users. Our expertise extends beyond traditional app development as we pioneer the integration of artificial intelligence into mobile solutions, creating smarter, more intuitive applications that adapt to user behavior and deliver personalized experiences.

Paro is an exclusive network of the very best on-demand financial professionals. Paro matches businesses with highly vetted financial analysts, CFOs, CPAs, and bookkeepers who have the domain expertise to tackle company-specific problems. Only the top 10% of finance freelancers make it through our screening process.

We founded Bevel in 2017 through a hunger for success, passion, life and most importantly - our work. We felt there was a need for a new kind of PR agency: one that combined events, SEO, digital media and traditional approaches to launch brands and further build brands through meaningful introductions.

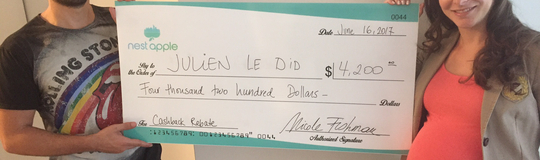

NestApple is an innovative brokerage firm based in New York. NestApple is designed to save on broker fees and disintermediate the residential real estate market. We provide all the benefits of a brokerage firm while getting a cash-back rebate to our clients. On top of it we make a donation to a local charity on every deal we close.

J.P. Morgan is a global leader in financial services, offering solutions to the world's most important corporations, governments and institutions in more than 100 countries. The Firm and its Foundation give approximately US$200 million annually to nonprofit organizations around the world. We also lead volunteer service activities for employees in local communities by utilizing our many resources, including those that stem from access to capital, economies of scale, global reach and expertise.

LendingTree was founded in 1996 by CEO Doug Lebda to help people comparison shop and get a great deal on the single biggest transaction of their lives: their mortgage. Since then, we’ve facilitated over 65 million loan requests, while becoming a household name.

Citi's mission is to serve as a trusted partner to our clients by responsibly providing financial services that enable growth and economic progress. Our core activities are safeguarding assets, lending money, making payments and accessing the capital markets on behalf of our clients.

CrossBorder Solutions, a pre-IPO SaaS company, is the global leader in technology-driven tax solutions. We stand at the intersection of human and machine intelligence. As we continue to grow and approach unicorn status, we have offices all across the world with over 300 employees to provide long-term client success. Through our AI and cloud-based technologies, we deliver superior solutions to our customers.

SQUIRE is the world’s leading and fastest-growing software technology platform for barbershops, a hundred-billion-dollar global industry. We provide a one-stop solution that helps small business entrepreneurs run and grow their businesses. SQUIRE is also the premiere booking engine that connects people with great barbers nationwide. We make it easy to discover and book the best barbers wherever you are, in just a few taps. With headquarters in New York and a presence in major cities in the United States, U.K. and Canada, SQUIRE is the market leader in technology solutions for the barbershop industry. SQUIRE is a Series D company and has raised over $165M to date. For more information, please visit getSquire.com or download the SQUIRE app from the App or Play Store.

.png)

.jpg)