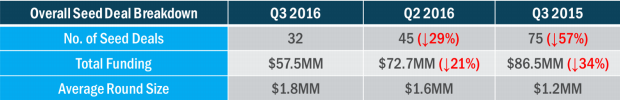

Turns out, the VC cooling trend we noted in our Q2 NYC Seed Deal Report is a bit chillier than anticipated. The venture industry has been slower to reset from 2015’s red-hot funding and valuation rates than many anticipated, with many VCs responding to ongoing market uncertainty with diminished appetite for risk. Q3 2016 saw just 32 Seed deals, totaling $57.5MM. The quarter saw 29% fewer deals than Q2 and 57% fewer than this quarter last year. From a dollars standpoint, we’re now down 21% from Q2 2016, and 34% from Q3 last year. As it stands, the VC funding total for startups in 2016 is on pace to see a 25% drop from 2015.

Looking out for numero uno

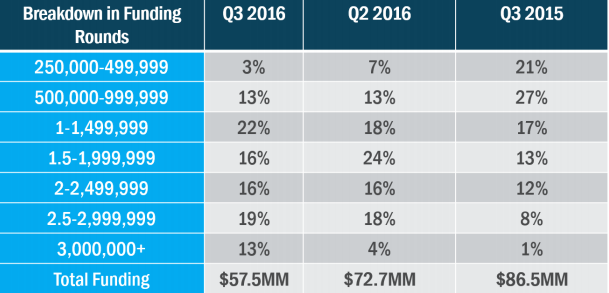

The cautious bug is a hard one to shake, as evidenced by the declining number of Seed fundings this quarter. But despite declining deal volume, average deal size continues to rise, indicating that investors are taking bigger swings at fewer companies and providing founders with enough cash to ride out potentially uncertain fundraising times ahead. This quarter saw a significant uptick in larger investments; 31% of Q3 deals fell into the $2.5MM-$3.3MM bucket, compared to 22% last quarter and just 9% in Q3 2015. Average round size was $1.8MM for the quarter, up almost 13% from last quarter, and 50% from this time last year. In an increasingly cautious funding environment, VCs continue to hunt for companies that show promising growth metrics and resiliency to withstand uncertain market forces. Our data suggests that they may be willing to wait for strong indicators before committing capital into uncertain ventures.

Step right up: The tech IPO window is open for business

We saw some early signs of life in the tech IPO market in Q2, with public filings from SecureWorks, Acacia Communications, NantHealth and, of course, Twilio, and people watched with bated breath to see how they would perform. Both Twilio and Acacia have posted strong numbers, and the market as a whole seems to have rebounded somewhat, ushering in a number of IPOs that bode well for tech companies. While international volatility and domestic drama continue to cause companies to question the value of the public route, it’s reassuring to see some VC-backed tech companies - Apptio, The Trade Desk, and Nutanix, which just IPO’d last week - take the plunge and prove that there’s still value to be had. Even with this latest flurry activity, however, the first three quarters of 2016 have seen just 75 IPOs, down 53% from this time last year.

Industries to watch

FinTech was hot, but is it losing steam?

The last few years have seen a bevy of new FinTech startups in NYC. Nearly every corner of the financial services landscape has been kissed by innovation - from the likes of early alternative lending leader OnDeck to personal finance innovators LearnVest, Betterment and Vestwell (one of our latest portfolio additions, which raised $4.5MM in Q3 and, therefore, falls outside the parameters of this Seed report), to new data plays like Quovo and API platforms like RegTech innovator Alloy (also a Primary portfolio company). A recent report by Accenture and the Partnership Fund for New York City noted that for the first three months of 2016, New York received more FinTech venture financing than Silicon Valley - $690 million in NYC compared to $511 million - reaffirming the city’s rise as a FinTech hub.

That’s good news from the perspective of overall dollars invested in the sector, but there was a noticeable drop-off in Seed-stage FinTech investments in Q3. In Q2, there were five new FinTech Seed deals (11% of total Seed deals for the quarter), compared to just one deal (Offrbox) this quarter. There could be a number of reasons for this. First, the sheer number of FinTech startups may be causing some investors (and entrepreneurs) to put on the brakes, lest they fall into copycat territory. But a more tangible reason for the momentary drop-off could be due to the public market slippage of two of the largest VC-backed fintech companies: OnDeck and LendingClub. OnDeck’s stock is down over 80% since it IPO’d in December 2014, while LendingClub has been coping disastrously since the sale of some unsavory loans and a resulting management shakeup in May. In an already gun-shy VC market, these results may be shaking investors’ confidence in the FinTech space. That said, we know of a number of FinTech companies still operating in “stealth” mode, and hope to see the final tally of Q3 FinTech deals rise as these companies launch publicly.

NextGen Commerce is back!

After a seasonably sluggish summer, it seems NextGen Commerce is showing some renewed bounce in its step, making up 20% of total Seed deals in Q3. We’re seeing continued momentum around consumer-oriented marketplaces, in particular those seeking to monetize underutilized assets such as conference room space (Bizly), or providing modern liquidity channels for categories such as sporting goods (SidelineSwap) and furniture (AptDeco).

The quarter also saw funding for a number of consumer education and content platforms, which continue to emerge as accessibility and affordability increase (Fluent City), and frontier technologies - such as VR - enable richer consumption experiences (WoofbertVR). Childhood education was a particularly noticeable trend in Q3, with funding going to KidPass and Space Race. Expect to see more of these platforms as unit economics and long-term engagement are further validated.

Of course, we’d be remiss not to mention Q3’s historic $3.3BN Jet.com exit, which we’re proud to have invested in very early on. This is truly a watershed moment for the NYC Tech community that will herald the next wave of large companies coming out of the city, and West Coast investors are increasingly taking note.

Healthcare focuses on communication

A number of healthcare startups received funding in Q3, particularly those focused on patient communication. Applications like Klara and NexHealth both received funding to help with patient booking and improving patient-provider communication, while FORCE Therapeutics aims to coordinate care for patients post-surgery. We believe care coordination will be a continued area of focus for many healthcare startups, and winners in this space will be those that target specific conditions or patient populations.

Drones, VR, AI, oh my...

Space-age technologies continue to build a presence in NYC. Silicon Valley's new darling, drones, has emerged on the East Coast, with Q3 funding for the inaugural Drone Racing League which began televising its first live events in September. And in case the drone racing doesn’t end well, Verifly picked up funding for a new category of on-demand drone insurance.

Both AI and virtual reality startups continue to see big jumps in investment activity, and this quarter continues that forward march with fundings for ensa - which connects your medical records with your health and fitness apps to give personalized wellness recommendations - and InsiteVR, which helps architects and 3D designers create immersive virtual reality experiences.

View a full listing of all Seed deals announced in Q3.

Looking ahead to Q4

The Q3 results don’t shake our optimism for a strong finish to the year. We’re already seeing a marked increase in the Seed deal pipeline for Q4, and with a number of new Seed funds in the works, the doors are open for more deals to close in the quarters ahead. And while risk-averse investors may continue to look for safer havens for their dollars, we anticipate that newcomers in digital health and AI companies that target specific industry verticals or functions (FinTech or healthcare, for instance) will continue to win their share of Seed dollars.

*It should be noted that the Primary NYC Seed Deal Report covers only those seed deals — which we define as $250,000—$3,500,000 — that have become public. We know there are deals that have closed but not yet been announced, including some of our own, and those will be added in once they are public.

Have a news tip for us or know of a company that deserves coverage? Let us know or tweet us @builtinnewyork.