You may have read about Seattle’s outcry after Fred Wilson penned a blog post naming the city a ‘third tier' startup city. The post named a number of hot tech cities and labeled them according to what Wilson believed their tier to be. The Bay Area alone comprised tier one, while New York, Los Angeles and Boston took tier two. Chicago, Seattle, Austin and a couple of other smaller markets were labeled tier three.

Apparently, the post didn’t sit well with Seattle-based PitchBook, which decided to do a study of which cities provide venture capital firms the best bang for their investments in response. It turns out that, at least according to PitchBook’s data, some smaller markets that Wilson had in his third tier were among the most profitable.

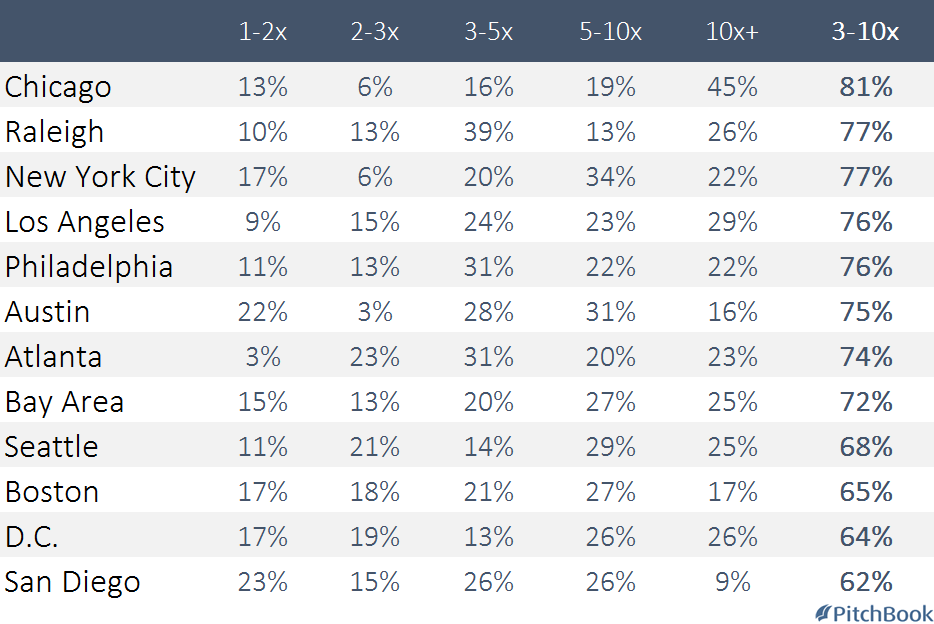

According to PitchBook, the city with the highest return on investment is Chicago, where 81 percent of investments yield between three and 10 times an initial investment. Just behind that was New York and Raleigh at 77 percent, then Los Angeles and Philadelphia at 76 percent. Austin was close behind at 75 precent. Interestingly, just 72 percent of Bay Area companies, Wilson's tier one area, can claim the distinction.

While this is impressive, the devil is in the details. Chicago and Raleigh only have 31 companies in the three to 10 times category, compared to New York's 98, Los Angeles' 87, and Philadelphia and Austin's 86.

Meanwhile, the Bay Area had a whopping 613. Talk about a venture capitalist’s paradise.

Anyway, you can find Wilson’s post here, and the full PitchBook study here.

Image via PitchBook.

Know of a company that deserves coverage? Let us know or tweet us @builtinnewyork.