Although community banks and credit unions make up the majority of America’s banking institutions, the industry is notoriously antiquated. They rely heavily on third-party tech providers that often use systems that are decades old, making it difficult for them to compete with the slew of challenger banks that have emerged in recent years.

This is where Mantl comes in.

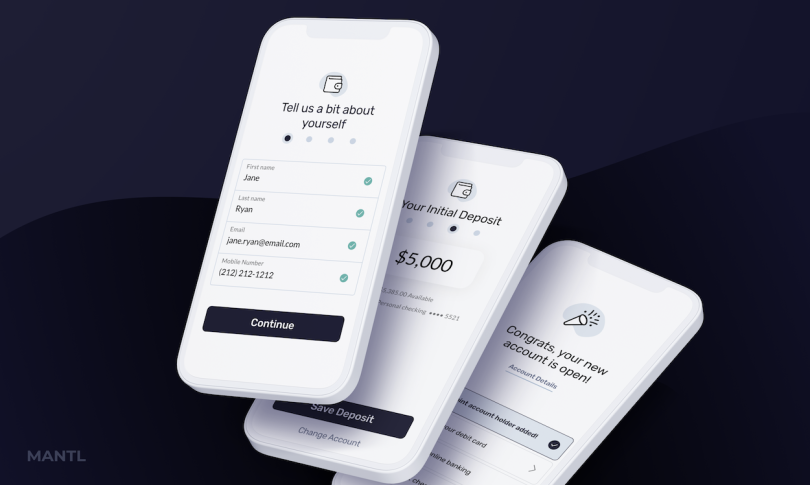

The NYC-based startup has developed technology that makes it easier for folks to open online accounts at these smaller financial institutions, and, as a result, help these institutions grow. With Mantl’s technology, people can open an account at a community bank or credit union from any device with just a few pieces of information, without having to download another app or sift through documents. All told, Mantle claims it can help someone open an account in less than three minutes, making it “among the fastest and most performant” solutions on the market.

Since its founding in 2016, Mantl says it has helped financial institutions onboard hundreds of thousands of customers and raised billions of dollars in core deposits. In 2020 alone, the company claims to have more than doubled its revenue, as more banks than ever raced to digitize amid the COVID-19 pandemic.

Now, Mantl has raised a fresh $40 million to keep up the momentum. The Series B was led by Alphabet’s independent growth fund, CapitalG, with participation from D1 Capital Partners, BoxGroup and others.

Jesse Wedler, a partner at CapitalG, believes Mantl’s “dedication to transparency and accountability” is setting the standard for what banks “can and should expect from their technology partners,” and that the company is poised to dominate the industry going forward.

“There is incredible demand for platforms that empower vital community institutions to compete in an increasingly digital landscape. The Mantl team has demonstrated that they have the strongest product and the most compelling vision for how to tackle this legacy infrastructure challenge,” Wedler said in a statement. “In addition to developing world-class technology, Mantl is also completely reimagining the technology vendor-customer relationship.”

Looking ahead, Mantl’s CEO and co-founder Nathaniel Harley sees account opening as “just the beginning.”

“We’re challenging the legacy infrastructure that is holding community institutions back,” Harley said in a statement. “Our purpose is to be a true digital transformation partner for community banks and credit unions who share our vision for the industry.”

To achieve that vision, Mantl plans to use this latest funding round to expand its product suite, which will include software designed to improve and digitize the onboarding process for businesses of all sizes, from sole proprietors to larger commercial enterprises. The company is also hiring, with more than a dozen open tech positions available now.