The buy now, pay later (BNPL) sector accounted for $97 billion in global e-commerce transactions last year. With giant BNPL platforms like Afterpay and Klarna raising their valuations into the billions, entrepreneurs Sam Miller and Kevin Kim set out to develop a better way to pay for e-commerce goods.

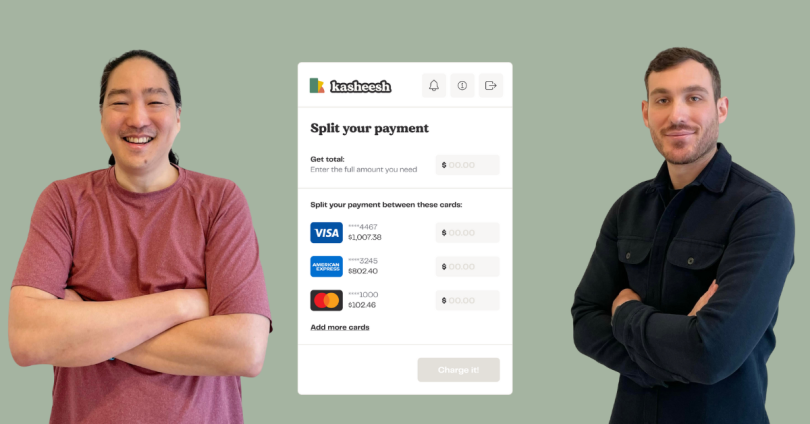

The two co-developed a new online split payment platform called Kasheesh. The process is similar to splitting a bill between cards at a restaurant but instead allows consumers to divvy up online payments among multiple cards. This, according to Miller, helps customers relieve the burden of debt and loans they may have otherwise obtained.

“Most people are used to paying for something with one form of payment, be it one card or BNPL alternatives. There’s a significant cost burden and risk when you’re forced to put an entire payment onto one card,” Miller, who also serves as the CEO of Kasheesh, said in a statement. “Kasheesh leverages existing spending power, not added debt. We maximize rewards versus maxing out cards.”

On Thursday, the NYC-based startup emerged from stealth with $5.5 million in seed funding from celebrities like football player Odell Beckham Jr. and actor Robin Wright.

“It feels amazing to see all of the support we’ve received,” Miller told Built In via email. “Having well-known public figures validates our mission to provide financing options for anyone and everyone.”

Kasheesh will use its funding to fuel hiring efforts alongside scaling its platform. Miller expects the current 10-person team to double in size by the end of the year with a focus on growing its engineering, customer success and partnerships management teams.

According to the company, Kasheesh has brokered over $11 million in user transactions and purchases. Unlike buy now, pay later platforms, the startup does not provide installment loans, it instead consolidates spending power to help its users avoid maxing out their credit cards.

“There’s clear consumer demand in alternative financing at checkout, and we saw a need beyond BNPL,” Miller said. “Consumers deserve the right to spend their money how they need to no matter the demographic [or] credit score they individually have, high or low.”