Maven Clinic, one of the largest virtual platforms dedicated to women’s and family health, just announced it closed on a $110 million Series D round co-led by Dragoneer Investment Group and Lux Capital. This brings Maven’s total funding raised to $200 million, and caps off a year of rapid growth. Now, the NYC-based startup will use this fresh capital to further innovate its product and expand into new markets.

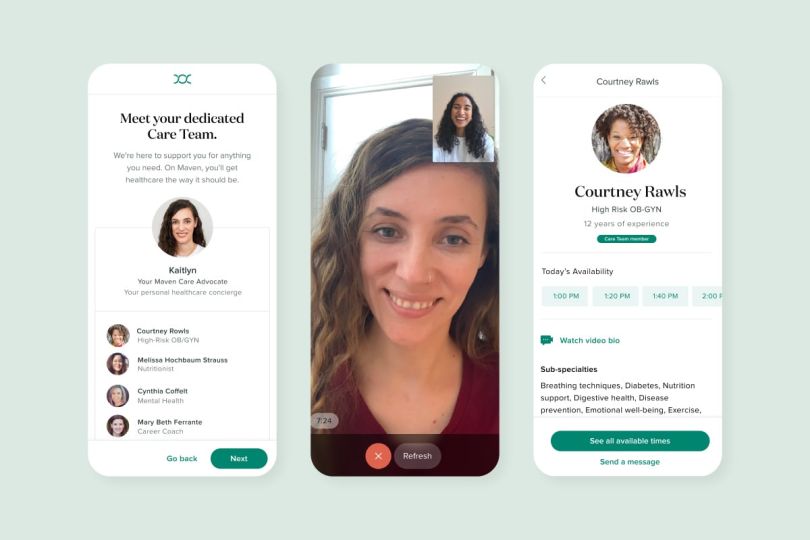

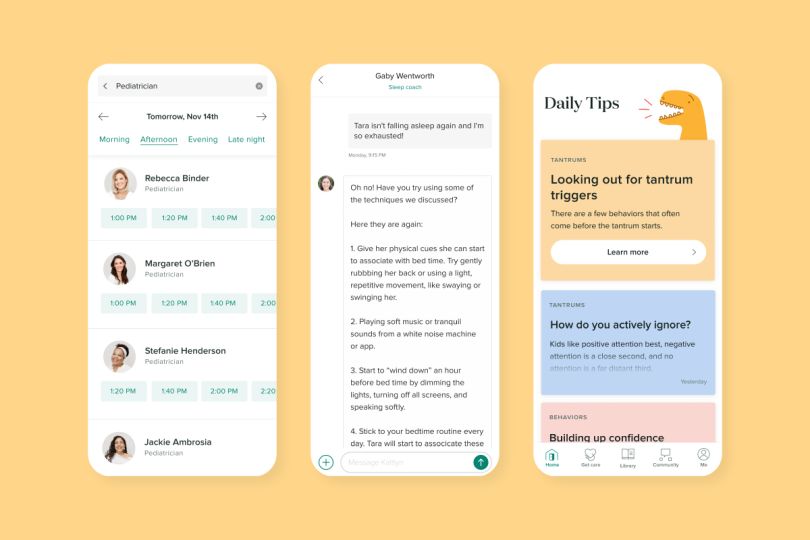

Maven’s telehealth platform offers on-demand access to a network of providers, including fertility specialists, adoption coaches, birthing doulas, pediatricians and child care experts. People can participate on a per-use basis, but the bulk of the business comes from large companies like Microsoft and Snap, which offer Maven as a benefit to their employees.

Built In last caught up with Maven when it closed on its $45 million Series C in February of 2020, mere weeks before the COVID-19 pandemic. And, like so many other telehealth startups, business has been booming ever since. Over the last 18 months, the company says it has “significantly” increased its client base across employers and payers, and grown its membership by 400 percent.

To keep up, Maven will also need to grow its team. The company currently has dozens of open tech positions available.

While it is one of the largest, Maven certainly isn’t the only telehealth platform in this space experiencing success. Over the last year, fertility companies like Kindbody and Mate have raised venture funding amid a rise in demand. Just this week, San Francisco-based fertility startup Carrot announced a $75 million Series C led by Tiger Global.

Deena Shakir, a partner at Lux Capital, says the larger women’s and family health space is “one of the defining categories in healthcare,” and sees Maven as a “clear category winner” that is poised to lead the way.

“While the path to parenthood is unique to each family, it is a source of emotional, physical and financial stress to nearly every family,” Shakir said in a statement. “Maven is the only platform that effectively serves parenthood journeys in all their depth and diversity, solving for the patient, employer and payer with one elegant solution.”

Over the years, Maven’s model and potential has attracted the attention of a bevy of celebrity investors as well, including Natalie Portman, Reese Witherspoon and Mindy Kaling. Billionaire businesswoman Oprah Winfrey just came on as a new investor in this latest raise.

This Series D brings Maven’s valuation to more than $1 billion, reportedly making it the first and only U.S. unicorn dedicated to women’s and family health. It also makes Maven the latest member of the small but mighty share of tech unicorns with a woman at the helm. Kate Ryder, a former journalist and VC investor, founded the company back in 2014, and is considered one of telemedicine’s early pioneers.

Today, a recent Crunchbase analysis found that nearly 40 private companies with women founders or co-founders hit unicorn status this year, including crypto-lender BlockFi, insurtech startup Sidecar Health, and Rihanna’s Savage X Fenty. 2021 has also been a record year for women-led companies making their public debut, including popular DNA-test provider 23andMe, dating app Bumble, and the Honest Company, an e-commerce brand founded by actress Jessica Alba.

Now, having hit this massive valuation milestone, Ryder says “the digital era for women’s and family health has arrived.”

“For far too long, this space has been under-researched, under-sized, and under-innovated, and, as a result, it’s profoundly underperforming, failing patients during some of the most challenging times in our lives,” Ryder said in a statement. “With the support of our new and existing investors, Maven will be able to deliver on the promise of digital health for women and families everywhere, offering personalized care that meets them where they are.”