Mobile banking startup Current announced Tuesday it closed on a $131 million Series C, bringing the NYC company’s total funding raised to $180 million. The round was led by Tiger Global Management.

Founded in 2017, Current started as a debit card for teens, allowing parents to track and control their children’s finances. The company has since expanded its offerings, focusing mainly on people who may be overlooked by traditional banks due to financial insecurity.

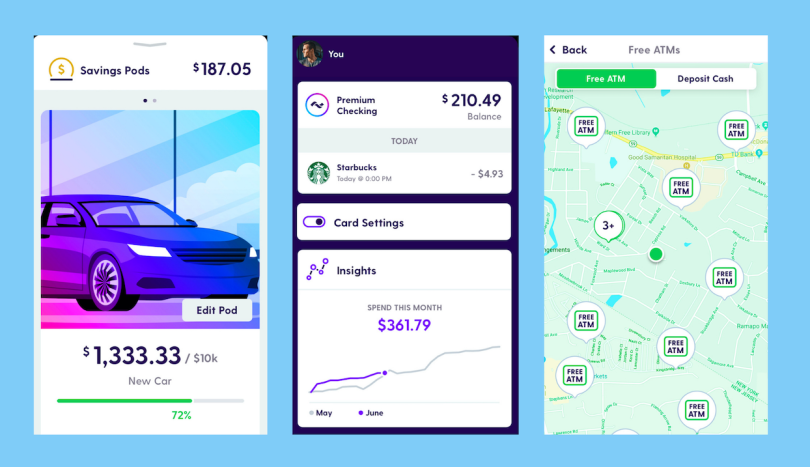

Now, the service offers various perks that are essential to folks living paycheck to paycheck — things like free overdrafts, no minimum balance requirements, free cashback, free ATMs, instant and free money transfers, as well as “saving pods” and other money management tools to promote responsible spending.

“We are committed to building products specifically to improve the financial outcomes of the millions of hard-working Americans who live paycheck to paycheck, and whose needs are not being properly served by traditional banks,” Current founder and CEO Stuart Sopp said in a statement. “We’re proud of our ability to deliver on our promises to our members, especially at times many needed it most this year.”

Indeed, Current has grown a lot this year. The last time Built In checked in on the company was last fall, when it had just hit 500,000 users. Today, it touts more than two million accounts, with membership doubling in just the last six months. Revenue has also grown, increasing by 500 percent year-over-year, according to the company.

Banks similar to Current have also been having a moment amid the pandemic, perhaps indicating a larger shift toward more affordable, socially conscious banking options. For instance, Earth-friendly banking startup Aspiration raised $135 million in May; Lili, an app made specifically for freelancers, raised $10 million in June; and Bella, a digital banking app that lets users gift up to $20 to strangers, launched just last week.

Now, with this fresh funding, Sopp says Current is poised to help close the financial inequality gap for the tens of millions of Americans living paycheck to paycheck. The company is also hiring, with dozens of open tech positions available now.

“We have seen a demonstrated need for access to affordable banking with the best-in-class mobile solution that Current is uniquely suited to provide,” Sopp continued. “Our growth this year highlights the need of so many Americans for faster access to money, and the trust we’ve built with them — and we look forward to accelerating in 2021.”