By now, we all know quip, the oral health company whose sleek and colorful toothbrushes now line the shelves of Target. The company has become synonymous with tech’s direct-to-consumer wave, and sold millions of toothbrushes in the process.

Today, quip announced the latest addition to its oral health arsenal: dental insurance. Following the acquisition of dental insurance startup Afora last year, quip has revealed plans for its own brand of insurance, designed to cut costs and inspire more people to take care of their teeth.

Getting into the insurance business might seem like a big leap for a toothbrush maker, but according to co-founder and CEO Simon Enever, the vision behind quip always went beyond brushes.

“From the inception of the company five years ago, we’ve been focused on helping people improve their oral health by making the entire oral care routine more simple, accessible, and enjoyable,” he told Built In. “At first, we focused on working to fix the important personal care habits most people got wrong, like not brushing for two minutes, twice a day, through our electric toothbrushes, toothpaste and brush head subscription.”

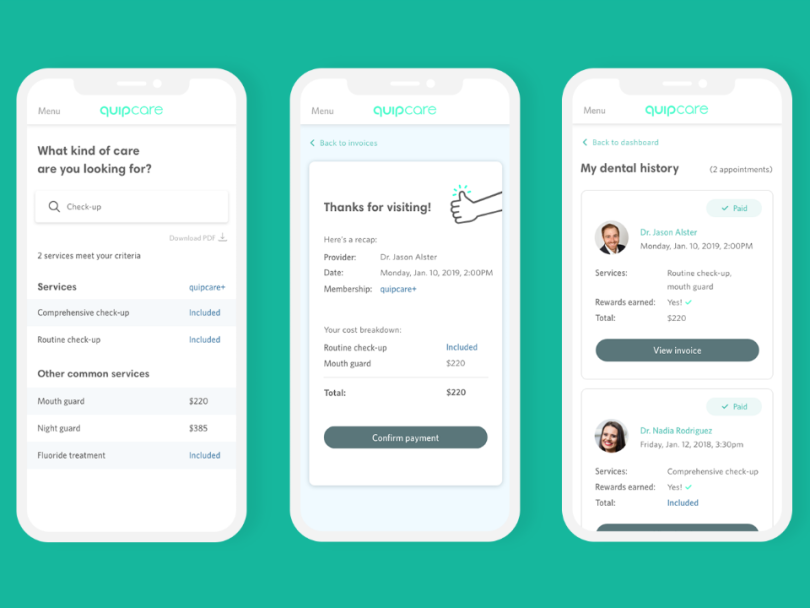

Quipcare, as the new system is called, is accessible via a free app, which gives users access to a range of pay-as-you-go services, which can be scheduled and paid for directly in the app. Users will also have access to their records within the app.

The goal is to get people to follow through with routine dental checkups. Because if getting new brush heads and brushing for two minutes seems like a lot to stay on top of, try figuring out how much your next dentist visit is going to cost you.

“There’s very little transparency around costs and quality, and the process of booking and paying for care is inconvenient,” Enever said. “The goal of quipcare is to overhaul and modernize this experience to make getting the professional dental care you need more transparent, affordable and simple. By doing this, we can help members improve this important part of their overall health, and have better health outcomes.”

In addition, quipcare offers a quipcare+ option for $25 a month. This feature gives users access to two preventative dental checkups each year. All members will also receive discounts of an estimated 30 to 40 percent on a range of other dental services.

According to quip’s research, as many as 25 percent of Americans don’t have dental insurance. Among those who do, 33 percent haven’t had a dental checkup in more than a year. While it may not be a facet of health that the typical American treats with a level of great importance, studies repeatedly indicate that oral health is critical, with experts at the Mayo Clinic even referring to oral health as a “window into your overall health.”

Yet, many people — even those with dental insurance — are kept from accessing the services they need due to sky-high costs. Profit margins in the dental insurance industry remain unregulated, allowing dental insurers to keep as much as half of the premiums they collect from patients.

As of today, quipcare is available only to users within New York City, where quip is headquartered.

“Due to our acquisition of the NYC-based Afora Dental plan in 2018, we have already had years of learning in the area with a similar type of plan to one of those on quipcare, and we were able to use this to accelerate the development of quipcare by leveraging the learnings and the network of the hundreds of NYC providers already on Afora,” Enever said. “With regulation and competition being more challenging in NYC than most states and cities, we believe a successful rollout here can lead to even more rapid and successful expansion across the rest of the country.”

The company is planning for a “wider national rollout” in 2020.